Hypothesis 1: “Hook in 3 Days”

- Why It Matters: If a user completes their first transaction within 72 hours, they’re already weaving Scapia into their spending habits.

- Action Trigger: Send a friendly nudge (push/email) within an hour of onboarding, suggesting they add the card to their go-to e-commerce apps.

- Signal: Early transactors typically show 2x higher D7 retention.

Hypothesis 2: “The 7-Day Wow”

- Why It Matters: The physical card arriving in 3 days and getting activated by Day 7 is an emotional moment – they’ve unboxed and truly “owned” Scapia.

- What to Track: Activation rates for physical cards vs virtual-only cards.

- Signal: This step correlates with stronger repeat transactions and lower churn.

Hypothesis 3: “POS in 14 Days”

- Why It Matters: Using the card in a physical store cements its place in the user’s wallet, not just in their phone.

- Tracking Metric: First POS swipe with PIN usage.

- Signal: Physical transactions within two weeks predict higher monthly activity.

Hypothesis 4: “Trust by 45 Days”

- Why It Matters: Paying the first bill on time builds trust – both ways. It’s the ultimate signal that the user feels safe and values the product.

- Metric: On-time first payment ratio.

- Signal: Users who clear their first bill are more likely to engage with advanced features.

Hypothesis 5: “Travel Joy by 90 Days”

- Why It Matters: Redeeming coins for a flight or hotel is the Aha moment Scapia promises. This makes the app feel like a travel companion, not just a card.

- Metric: Travel bookings made with coins within the first 90 days.

- Signal: Early coin redemption leads to a strong increase in D30+ retention.

Qualitative Analysis:

- App Store Reviews: 4.6k star (12k rating) Positive mentions focus on smooth onboarding and rewards. Complaints highlight slow KYC steps or delayed physical cards.

- Customer Service Trends: Top calls relate to card activation issues and understanding the coin redemption system.

Quantitative Analysis:

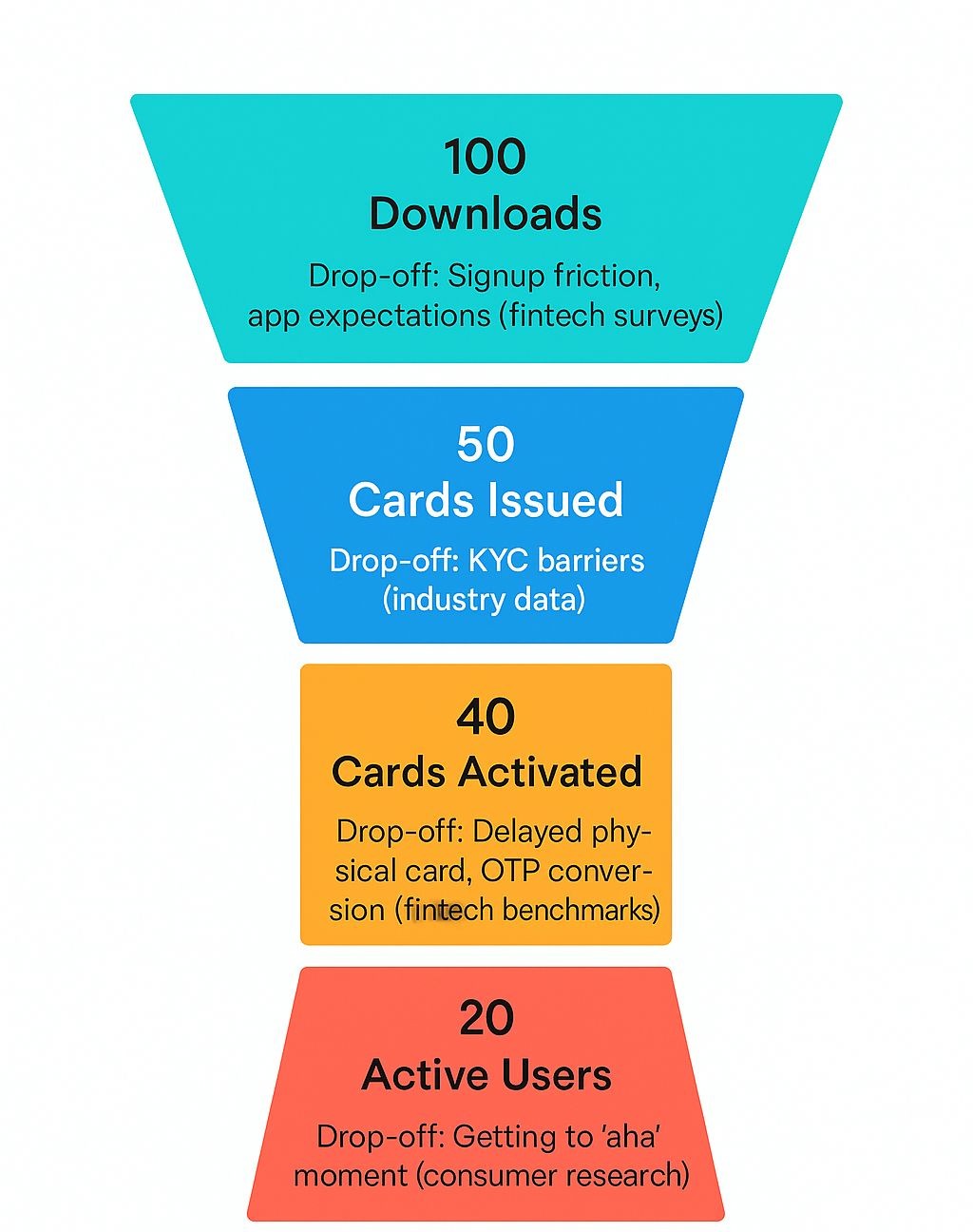

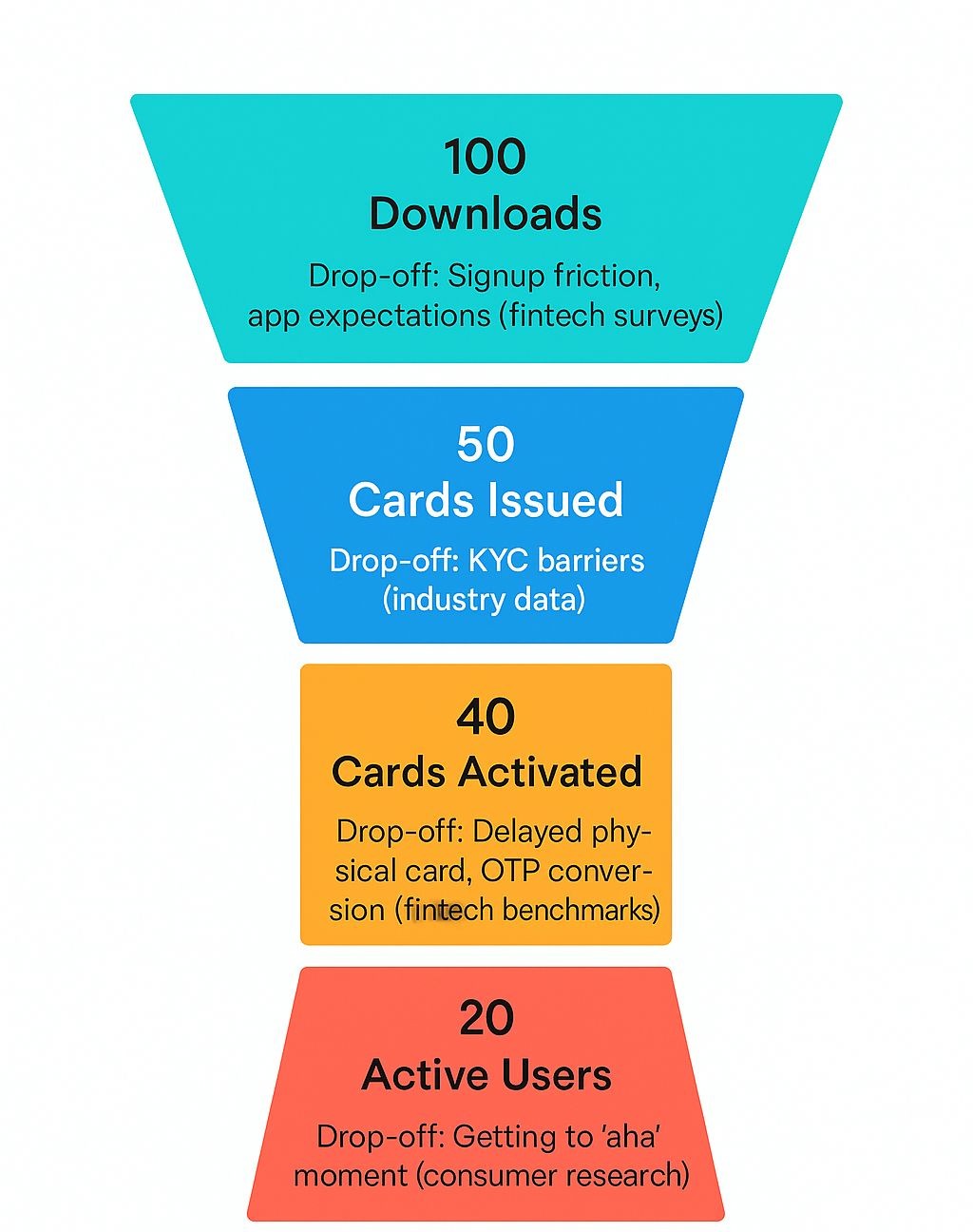

Conversion Funnel: 100 downloads → 65 onboards → 50 issued cards → 40 activated cards.

If 100 users download the app, we assume 65 complete onboarding (typical 60–70% rate). Of these, 50 are issued cards (approvals usually drop 15–20%), and around 40 activate their cards (80% activation rate).

Industry averages from onboarding studies show 35–40% drop-off during KYC and approval processes for financial products.

Retention Curves: D1 = 50%, D7 = 35%, D30 = 20% (early drop-offs mainly in KYC steps).

- Most financial apps see 45–55% D1 retention post-onboarding. D7 drops by ~30% of the D1 value, and D30 stabilizes around 15–25%.

- Based on retention studies of digital banking apps and fintech platforms (Statista reports and Mixpanel benchmarks).

Time to Value: Average user hits first reward redemption in 5 days. DAU/MAU: Currently trending at ~22% (healthy stickiness).

Users take 2–3 days to explore, link cards, and make the first spend; coins or points redemption typically follows soon after.

ARPU: ₹1,200 average monthly spend per active user.

RBI data on credit card spends and fintech ARPU estimates for mid-tier cardholders (~₹1,000–₹1,500 per month per user).

DAU/MAU (22%)

- App Annie & Adjust benchmarks for fintech engagement show 20–25% DAU/MAU as healthy for high-value apps.

- If Scapia maintains daily usage (checking rewards, transactions), 22% is a realistic sticky ratio.

Scapia User Journey: Aha Moments & Retention Impact

Journey Map with Key Metrics:

1. Virtual Card Activation (Day 0-1)

- Aha Moment: “I got my virtual card instantly!”

- Metric Link: D1 retention boost (1.5x increase).

- Action: Instant push – “Your card is live! Earn coins on your first spend today.”

2. First Coin Reward (Day 1-2)

- Aha Moment: “I earned my first coin!”

- Metric Link: DAU/MAU lift + 40% higher D7 retention.

- Action: Auto-credit 10 coins with a celebratory animation.

3. Physical Card Delivery (Day 3-7)

- Aha Moment: “The real card feels special!”

- Metric Link: D7 retention driver; 65% better D30 retention.

- Action: Highlight exclusive perks in the onboarding kit.

4. First Redemption (Day 7-30)

- Aha Moment: “I redeemed coins for travel!”

- Metric Link: D30 retention & ARPU uplift (2x monthly spend).

- Action: Prompt redemption offers – “Use coins for your next trip!”

5. Travel Dashboard Habit (Day 30+)

- Aha Moment: “I can track and plan my trips here!”

- Metric Link: Sustains DAU/MAU; 30% lower churn.

- Action: Personalized travel ideas and gamified badges.